Truist Mobile

Rating: 0.00 (Votes:

0)

Your better banking experience is here.

Check balances, make payments, get personalized insights, and move money at your convenience. Enjoy smarter technology and innovative features that put you first so you can manage your finances with confidence.Accounts & cards

* View account details and transactions

* Set alerts preferences

* View statements1

* Order checks and supplies

* Manage overdraft options

* Lock and unlock your cards

* Set spending and region limits

Transfer & pay

* Transfer between Truist accounts or external accounts2

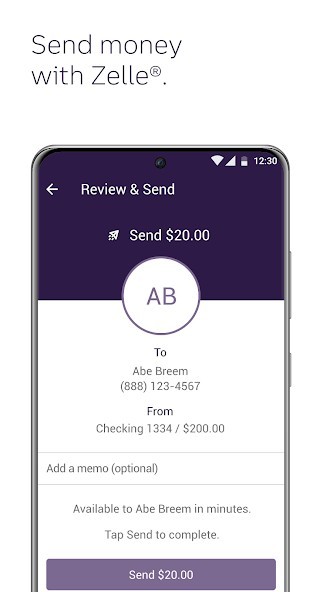

* Send and request money with Zelle®3

Sign in & security

* Enable fingerprint or facial recognition for quick access

* Change your user ID and password

* See sign-in history and remembered devices

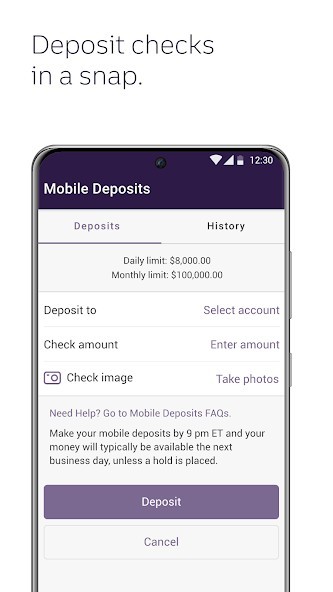

Mobile deposits

* Deposit checks4

* View deposit history

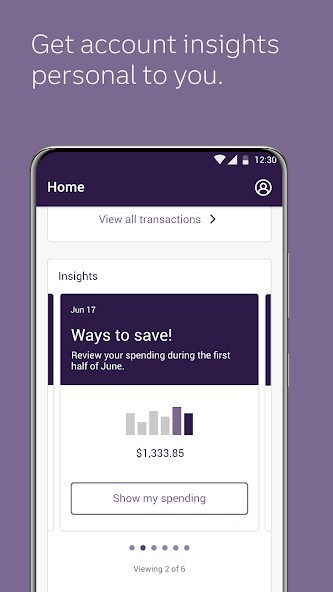

Planning & insights

* Get insights on spending, trends, cash flow, and unusual activity

* Link external accounts

* Set and track spending budgets

* Compare spending habits

* Monitor savings goals

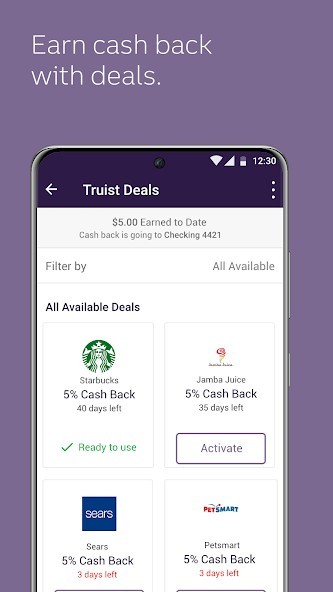

Rewards & deals

* Earn cash back on everyday purchases at select merchants

* Discover offers from places you shop, dine, travel and more

* View and redeem credit card rewards

Help & support

* Call Truist support

* Find a branch, ATM, or bank service

* View help & FAQs

* Schedule an appointment

* Access your Truist inbox

Additional features

* Add quick links for frequently used tasks

* Show, hide, and reorder accounts

* Browse and apply for other Truist accounts

* Upload receipts and attach to transactions

* Customized investment portfolio experience.

1 Paperless enrollment is required.

2Fees may apply to transfers to other U.S. financial institutions. Setup is also required and verification may take 1 – 3 business days. View the Truist Personal Deposit Accounts Fee Schedule for more information. Your mobile carrier’s message and data rates may apply.

3 Neither Truist nor Zelle® offers a protection program for payments that you authorize in Zelle. Enrollment with Zelle through Truist Online or Mobile banking is required. U.S. checking or savings account required to use Zelle. For more information, view the Truist Online Services Agreement.

4 Deposit limits and other restrictions apply.

Zelle® and the Zelle related marks are wholly owned by Earning Warning Services, LLC, and are used herein under license.

Investment and Insurance Products:

• Are Not FDIC or any other Government Agency Insured

• Are Not Bank Guaranteed

• May Lose Value

Services provided by the following affiliates of Truist Financial Corporation (Truist): Banking products and services, including loans and deposit accounts, are provided by Truist Bank, Member FDIC. Trust and investment management services are provided by Truist Bank, and Truist Delaware Trust Company. Securities, brokerage accounts and /or insurance (including annuities) are offered by Truist Investment Services, Inc., and P.J. Robb Variable Corp., which are SEC registered broker-dealers, members FINRA, link opens in new tab SIPC, link opens in new tab and a licensed insurance agency where applicable. Investment advisory services are offered by Truist Advisory Services, Inc., GFO Advisory Services, LLC, Sterling Capital Management, LLC, and Precept Advisory Group, LLC, each SEC registered investment advisers. Sterling Capital Funds are advised by Sterling Capital Management, LLC. Insurance products and services are offered through McGriff Insurance Services, Inc. Life insurance products are offered through Truist Life Insurance Services, a division of Crump Life Insurance Services, Inc., AR license #100103477. Both McGriff and Crump are wholly owned subsidiaries of Truist Insurance Holdings, Inc.

User ReviewsAdd Comment & Review

Based on 0

Votes and 0 User Reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

Other Apps in This Category